Open banking could save your business a chunk of time and money, while streamlining your operations. In fact, on average it can save 150* hours of operational time each year.

That’s according to new Payit™ research, which reveals that many businesses could benefit from open banking in a fast-paced financial landscape. They include:

- offering a wider choice of customer payments

- lower payment processing costs and fees

- significantly less time spent on operational tasks

- tackling common business inconveniences

- a strong commitment to security standards

- smoother customer experiences

- access to real-time financial data.

Now in its sixth year, open banking allows businesses and customers to share their bank account data with secure third parties. These services are fuelling faster payments, quicker borrowing applications, and simpler invoicing.

Payit surveyed 150 chief executives, chief financial officers and decision-makers from UK businesses with annual revenues of £2 million or more, to find out their pain points with operational finances and how open banking helps.

The good news? Our findings reveal plenty of open banking advantages – from lower processing fees to less time chasing late payments. On the other hand, concerns around security mean some organisations may not be seeing the benefits just yet.

*Based on a typical 37.5 hour working week. Total open banking savings a month add up to 12 hours and 33 minutes a month, equalling to 150 hours saved throughout a year based on a typical 37.5 hours working week.

Open banking starts to make a breakthrough

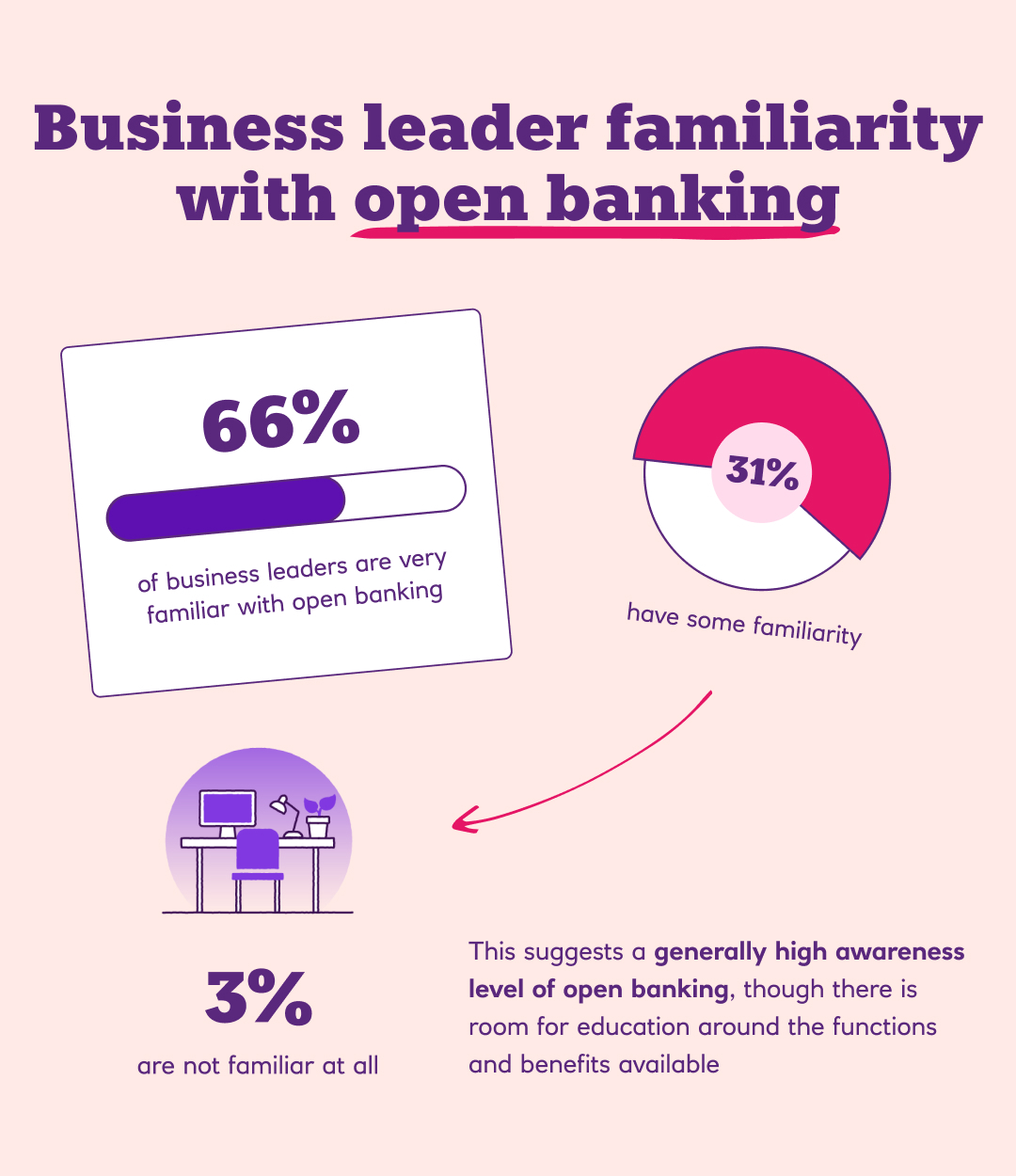

In such a digitally savvy country, it’s perhaps no surprise that most business leaders are already familiar with the benefits of open banking. Two thirds (66%) say they’re very familiar with this tech, while 31% have some familiarity.

At the other end of the scale, 4% have little to no awareness of open banking. So, there’s still some room for improvement for businesses to learn how the technology can help them.

Businesses with higher revenues tend to be more familiar; while 57% of those in the £2-10 million range are aware of open banking, this jumps to 75% with revenues of above £500 million.

Boosting the choice of customer payments

Many businesses have already spotted the advantages of open banking for their operations and customers, with 68% using the technology.

They’ve added it to a wide mix of payment options, with credit cards (90%), bank transfers (82%), and debit cards (76%) also popular.

Three in five (60%) use cash payments, while 72% use invoices. From open banking payments to banknotes, it all adds up to offering a wide and flexible choice for customers.

Open banking users trim payment costs

Saving on payment processes like debit and credit card processing fees is just one area where open banking could offer major benefits to businesses.

While many companies choose to offer a varied and flexible mix of payment methods to meet different customer needs, open banking holds the potential to deliver significant savings.

Overall, more than one in five (23%) organisations spend £20,000 to £50,000 on payment processes each year, whereas 15% spend between £10,001 and £20,000. More than a tenth (13%) splash out over £50,000 annually.

But open banking users could make some helpful savings here. Their spending on payment processes (£18,965) is 8% lower than the wider average (£20,652).

The same goes for processing fees. Overall, 25% of firms spend between £7,000 and £10,000 on these fees annually, 21% spend between £5,000 and £7,000, and 17% spend up to £5,000. For 9%, the bill for these fees comes to more than £50,000 each year.

Open banking users typically spend £14,672 on processing fees, compared to the wider average of £15,789.

Non-users miss out on time savings

Smoother and more efficient operations could also be among the advantages of open banking.

When added up over a month, open banking users spend 44 hours and 36 minutes on operational tasks, compared to 57 hours and 9 minutes for those yet to take the plunge. This monthly difference of 12 hours and 33 minutes isn’t to be sniffed at. Over a year, the saving comes to a huge 150 hours and 36 minutes, which is just over four working weeks.

Open banking users spend less time processing invoices each month compared to non-users (12 hours and 22 minutes, versus 16 hours and 43 minutes).

They also spend less time on recurring payments (10 hours and 11 minutes, against 13 hours and 10 minutes); ensuring data is processed and secured correctly (11 hours and 9 minutes, versus 14 hours and 40 minutes); and chasing late payments (10 hours and 54 minutes, compared to 12 hours and 36 minutes).

Open banking could ease the headaches of routine financial tasks and boost operational efficiency for businesses. For example, lowering the data burden, since there’s no need to store and maintain customers’ payment data. Meanwhile, automated financial management could end the days of manual data entry, cutting time spent on these tasks, as well as reducing the risk of errors.

Making business life more convenient

From delayed payments to security issues, your business may have lots of timely inconveniences to deal with over the years. Once again, the open banking benefits are clear to see here.

Late payments (27%) and the speed of payments (27%) are the highest reported business inconveniences overall. But by breaking down the figures, we can see a big difference between open banking users and other firms.

For example, only 26% of open banking users flag late payments as an issue, compared to 42% of non-users. The trend is similar for the speed of payments for the different users (26% versus 38%). This may be because open banking offers near-instant settlements in majority of cases. open banking solutions are simple to use as well, allowing payments in just a couple of clicks.

Having issues with multiple financial management systems (23%) and security (21%) are other pain points across all the businesses within our survey. Yet there seem to be open banking advantages here too.

Just 22% of open banking users report multiple financial management systems as being an inconvenience, against 29% of non-users. And fewer open banking users are concerned about data security (21% versus 25%).

Security named top priority for payment solutions

When ranking ideal payment solutions, businesses are mainly after efficiency, security and financial insights. You’ll be pleased to hear that these features could be found within many open banking services.

Security (35%) is their top priority, followed by payment and invoice automation (19%), and financial savings or growth (18%). Accessibility (15%) is also a big deal, along with speed and affordability.

Open banking offers lots of payment innovations, while also keeping security at its heart and rigorously in check.

The likes of payment links and QR codes give customers a hi-tech alternative to cards and cash, and could lead to more cost-effective and convenient transactions. They could remove the need for customers to manually enter their bank account details, making everything more secure. And it’s all backed up by tight regulation as open banking’s security profile is based on Finance Grade API specifications, similar to that of traditional banking security, and is regulated by the FCA or National Competent Authority.

Open banking could also open the door to automated financial tasks. Think payslip management, payment tracking, and invoicing, for starters.

Customers key when improving financial operations

A better customer experience is the main goal of businesses when revamping their financial operations. Nearly two fifths (39%) would like to target this, followed by improved payment efficiencies (37%), lower operational costs (37%), better management of their finances (36%), and cost savings (35%).

Almost half (44%) of open banking users say they’re aiming for an improved customer experience. This falls to a third (33%) among other firms.

Open banking could reduce friction between a business and its customers – especially when sending or collecting payments. For example, open banking solutions like Payit handle transactions in a matter of quick taps, with no need for card or bank account numbers. Payment requests could also be sent securely via email, letter, WhatsApp, or SMS. This makes things simple for customers and could boost the cashflow of a business.

Learn more about sending and collecting payments with Payit.

Eyes on the prize of real-time financial data

Real-time financial data is another area where business leaders are eyeing opportunities. More than a quarter (27%) feel it improves productivity. A stronger customer experience (21%) and better-informed decision-making (20%) are other plus-points.

Access to this data is also among the benefits of open banking for customers and businesses. For example, it could lead to near-instant payment settlements, same-day refunds, smooth recurring payments, and less data handling.

Security fears remain despite open banking advantages

Open banking has already won over many business leaders. But a range of concerns are holding some organisations back. Cybersecurity risks (48%) and existing business priorities (26%) are among the top hurdles.

Other firms named infrastructure compatibility, low customer awareness, and data loss risks as open banking issues playing on their minds to tackle before implementing the technology.

In reality, open banking is all about consumer safety and data security. Since there’s no need to know customer bank account details, it could reduce the risk of fraud. And here are some other handy features that could calm boardroom nerves:

- Bank-level security. Customers only need to hand account login details to their bank when making payments.

- Strong regulation. In the UK, open banking apps and services need to be regulated by the Financial Conduct Authority, with similar standards to those of traditional banks.

- Tight control over your data. Each person can decide when and how long they allow access to their data.

- Data protection. Banks often refund customers in the rare event of an unauthorised payment. As an added bonus, data protection laws apply too.

Learn more about Payit security.

Open banking could offer so many benefits, from speedier payments to easier borrowing applications. It could support business strategies by cutting costs and time spent on day-to-day tasks. Meanwhile, real-time financial data could boost your decision-making and customer experiences.

With a variety of security measures keeping data safe, the open banking journey is only just beginning.

Keen to explore open banking payments? Discover how to get started with Payit.

Take a look at our case studies to see how we’ve supported businesses in the real world.

Eligibility criteria and fees apply. You must hold a business current account with the NatWest Group and you will need to sign up to full Payit™ terms and conditions. You will need to allocate technical resources to work with NatWest to integrate the solution. Fees are based on the volume and average value of e-commerce transactions. Speak to a NatWest Relationship Manager for further information.

Methodology

Audience: 150 chief financial officers, chief executives, and financial decision-makers across UK organisations with an annual revenue of £2 million or more.

Survey period: 8th-13th December 2023.

The survey was unbranded for all respondents.

Panel Provider: Payit® via OnePoll.