With all the potential benefits of Open Banking, from improved security to smoother payment processes, it seems like an obvious choice for British businesses. However, card payments remain the most common payment option in the market.

We partnered with Censuswide to find out what payment challenges UK businesses face, and what’s holding them back from embracing Open Banking.

The results uncovered some common themes and the need for greater education on what Open Banking is and how it can benefit businesses.

Two-thirds of businesses (67%) have faced issues with their current payment processes, which has disrupted their business operations.

Payment friction is costing UK business owners time and money, which could be better spent on growing the business.

Open Banking could be the ideal payment system for businesses looking for a faster, more secure alternative. So why aren’t more companies adopting it?

Businesses can’t embrace what they don’t understand.

Over a quarter of businesses (28%) admitted that they had not yet adopted Open Banking due to a lack of understanding.

Card payments have become so embedded as the default option for transactions, that many don’t think to look for new payment systems that might serve them better.

But Open Banking solutions like Payit by NatWest could be the key to unlocking faster, more secure payments, and delivering better customer experience in the process.

“Increasingly, businesses from all sectors are realising that there are more efficient and secure payment methods, such as open banking. Payit by NatWest delivers solutions that enable businesses to provide choice and be more efficient with their payments and treasury operations”

Lee McNabb, Head of Group Payments Strategy at NatWest

In fact, the biggest challenges UK businesses reported were all things that could be overcome by the adoption of Open Banking.

There’s a need for speed

Slow payments are a significant issue for businesses, with almost half (49%) saying payment processing isn’t fast enough and almost a quarter (23%) reporting that payments can take over three days to clear.

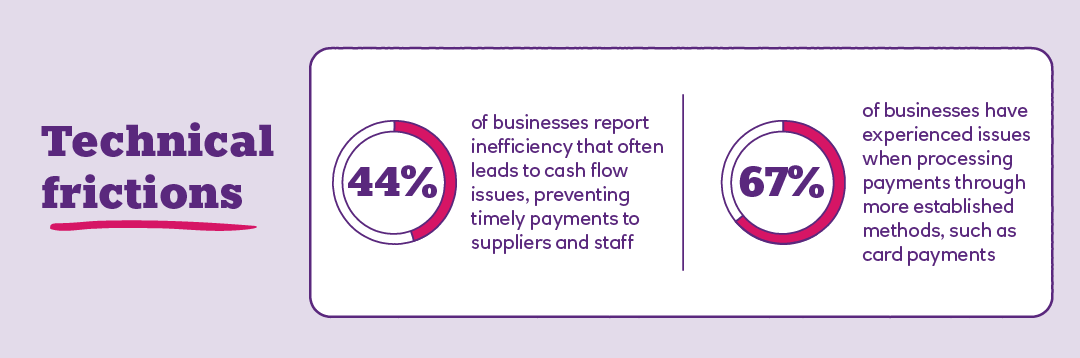

In fact, this delay in funds clearing has serious knock-on effects for many companies, with 44% experiencing cash flow issues due to inefficiencies in the payment process.

This lag in payment processing times can hurt the customer too. Over half of the surveyed businesses (56%) said that slow refund processes negatively impacted their customer experience.

Open Banking solutions like Payit have an incredibly fast settlement time, with funds landing in the account almost instantaneously. This means no waiting around for payments to clear, and no cashflow issues for businesses due to funds pending.

Make it easy for your customer

Even when payments are fast and transactions clear in good time, businesses can lose out on sales due to a complicated user experience at checkout. A badly designed payment gateway could be the difference between a completed purchase and an abandoned basket.

Over half (51%) of the businesses we surveyed reported complicated checkout journeys hurt sales.

Open Banking makes payments simple for the customer, with no need to enter card details at checkout.

The right solution can also help foster more consumer trust throughout the payment process. Payit integrates with your API so that you have full control over the look and feel of your checkout, creating a seamless customer journey.

It’s all about trust

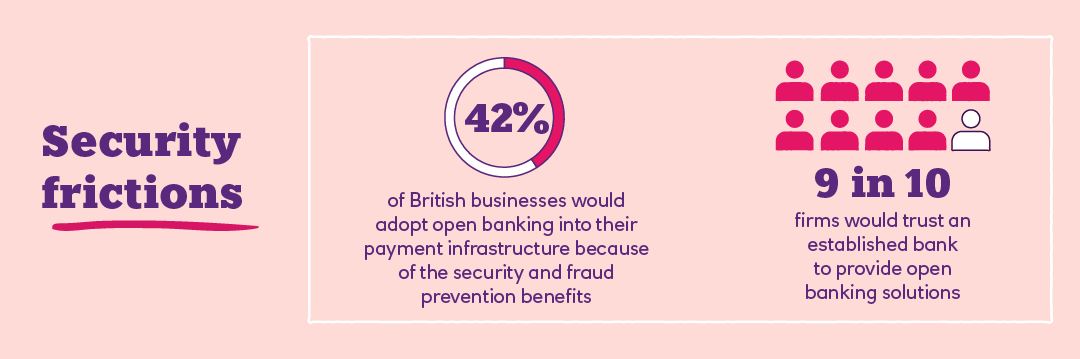

Perhaps the most compelling reason for businesses to consider Open Banking is the increased security it offers.

Open Banking reduces vulnerability to data theft and fraud, by removing the need to store sensitive information like card details, something that one in five businesses spend more than six hours per month managing.

Companies are beginning to see the benefits this could bring, with just over two fifths (42%) saying they would adopt Open Banking for its security and fraud prevention benefits.

It’s also clear that businesses are looking for partners they can trust when it comes to implementing these solutions, with 90% saying they would trust an established bank to provide Open Banking solutions, compared to 76% who would trust fintech companies for the same services.

Because Payit is part of Natwest, a trusted bank serving over 19 million people, you know you’re in good hands.

Since we launched Payit in 2020 we’ve won awards for our service, including ‘Open Banking Initiative of the Year’ at the 2024 Payments Awards as well as ‘Best use of Open Banking by Non-financial services company’ at the 2023 Open Banking Expo awards as a result of our work with JS Group.

Explore our Payit hub to find out more about how Payit could help you unlock improved payments for your business.

Methodology

Research conducted by Censuswide sampling 801 UK Respondents aged 25+ (Treasurers, Heads of Payments, Heads of Strategy and Chief Investment Officer etc.) between 21.02.2025 - 27.02.2025.